Can You Use a Cash App Card on PayPal? A Comprehensive Guide

In today’s digital age, managing finances often involves juggling multiple platforms and payment methods. Two prominent players in this space are Cash App and PayPal. Many users find themselves wondering, can you use a Cash App card on PayPal? This article provides a comprehensive exploration of this question, offering insights into the compatibility, limitations, and alternative solutions for integrating these two popular services.

Understanding whether you can use a Cash App card on PayPal is crucial for optimizing your online transactions and managing your funds effectively. We’ll delve into the technical aspects, explore potential workarounds, and provide practical advice to help you navigate the intersection of Cash App and PayPal.

Understanding Cash App and Its Card

Cash App, developed by Block, Inc. (formerly Square, Inc.), is a mobile payment service that allows users to send and receive money. It also offers a Visa debit card, known as the Cash Card, which can be used for online and in-person purchases. The Cash Card is linked directly to your Cash App balance, providing a convenient way to spend your funds.

Key Features of Cash App and the Cash Card

- Instant Transfers: Send and receive money instantly with other Cash App users.

- Cash Card: A customizable Visa debit card linked to your Cash App balance.

- Direct Deposit: Receive paychecks and government benefits directly into your Cash App account.

- Investing: Buy and sell stocks and Bitcoin directly through the app.

- Boosts: Save money with instant discounts at various retailers.

Understanding PayPal and Its Functionality

PayPal is a global online payment system that facilitates secure transactions between individuals and businesses. It allows users to link bank accounts, credit cards, and debit cards to their PayPal accounts, enabling them to make purchases and send money online. PayPal is widely accepted by merchants worldwide, making it a versatile payment option.

Key Features of PayPal

- Secure Transactions: Protect your financial information with PayPal’s encryption technology.

- Global Payments: Send and receive money internationally.

- Buyer Protection: Get a refund if your eligible purchase isn’t as described or doesn’t arrive.

- Seller Protection: Protect yourself from fraudulent transactions.

- Integration with Online Stores: Easily integrate PayPal as a payment option on your e-commerce website.

Can You Directly Link a Cash App Card to PayPal?

The central question remains: can you use a Cash App card on PayPal? The short answer is generally yes, but with some caveats. PayPal allows users to link debit cards and credit cards to their accounts for making payments. The Cash App card, being a Visa debit card, should theoretically be compatible with PayPal’s system.

However, some users have reported issues when attempting to link their Cash App card to PayPal. These issues can stem from various factors, including:

- Card Verification: PayPal requires users to verify their linked cards. This process involves PayPal making a small temporary charge to the card and asking the user to confirm the amount. Sometimes, the verification process fails with Cash App cards.

- Card Restrictions: Cash App may have certain restrictions on where and how the Cash Card can be used. These restrictions might interfere with PayPal’s verification or payment processes.

- Account Settings: PayPal account settings or security measures might prevent the linking of certain cards.

Troubleshooting Issues When Linking a Cash App Card to PayPal

If you encounter problems when trying to link your Cash App card to PayPal, here are some troubleshooting steps you can take:

Verify Card Information

Ensure that you have entered the correct card number, expiration date, and CVV code. Even a small typo can prevent the card from being linked.

Check Cash App Balance

Make sure that you have sufficient funds in your Cash App balance to cover any potential verification charges from PayPal.

Contact Cash App Support

Reach out to Cash App support to inquire about any restrictions on your Cash Card that might be preventing it from being linked to PayPal. They may be able to provide specific guidance or remove any relevant limitations.

Contact PayPal Support

Contact PayPal support to see if there are any issues with your PayPal account that might be preventing the card from being linked. They can also provide assistance with the card verification process.

Try a Different Card

If possible, try linking a different debit or credit card to your PayPal account to see if the issue is specific to the Cash App card.

Alternative Methods for Using Cash App with PayPal

If directly linking your Cash App card to PayPal proves problematic, there are alternative methods you can use to integrate the two services.

Using a Bank Account as an Intermediary

One workaround involves linking your bank account to both Cash App and PayPal. You can transfer funds from Cash App to your bank account and then from your bank account to PayPal. This method adds an extra step but can bypass the issues associated with directly linking the Cash App card.

Here’s how to do it:

- Link Your Bank Account to Cash App: Go to the “Banking” tab in Cash App and link your bank account.

- Transfer Funds from Cash App to Your Bank Account: Initiate a transfer from your Cash App balance to your linked bank account.

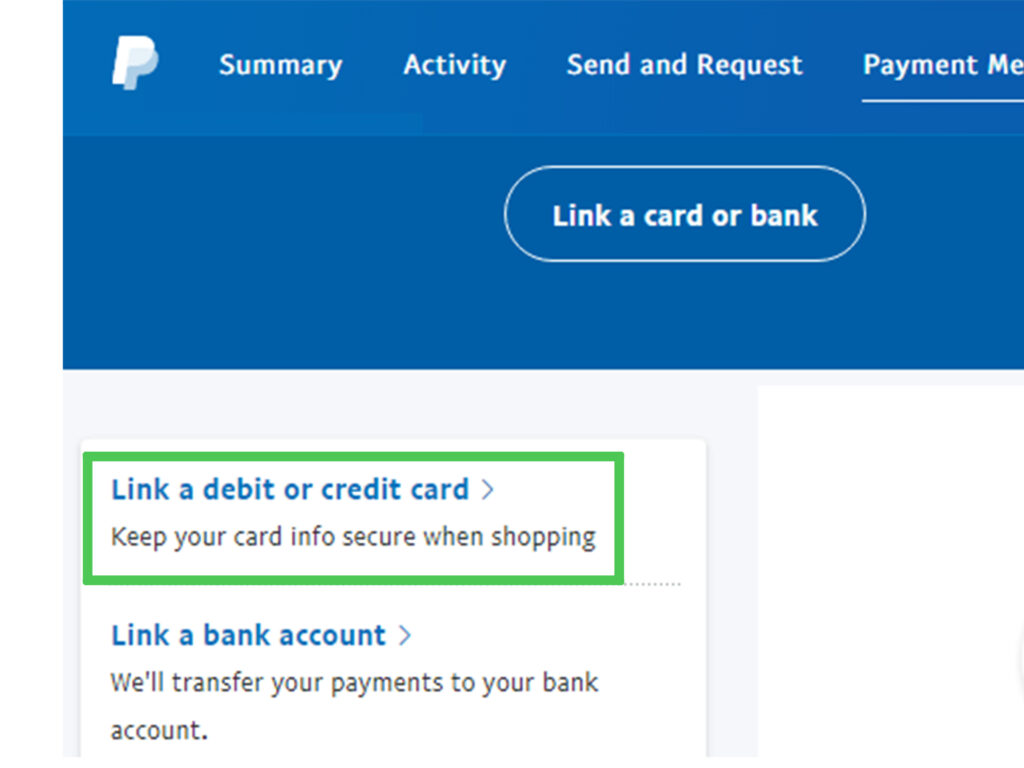

- Link Your Bank Account to PayPal: Go to your PayPal wallet and link the same bank account.

- Transfer Funds from Your Bank Account to PayPal: Add funds to your PayPal balance from your linked bank account.

Using a PayPal Cash Card

PayPal offers its own debit card, the PayPal Cash Card. If you frequently use PayPal, consider getting a PayPal Cash Card. You can transfer funds from your PayPal balance to the PayPal Cash Card and use it for purchases, effectively bridging the gap between your PayPal account and a physical card.

Sending Money to Another User

Another method involves sending money from Cash App to a friend or family member who also has a PayPal account. They can then transfer the funds to their PayPal account and send them back to you or use them for their own purposes. This method requires trust and coordination but can be a viable option in certain situations.

Why Might a Cash App Card Not Work on PayPal?

Several factors can contribute to a Cash App card not working on PayPal. Understanding these reasons can help you troubleshoot the issue more effectively.

Security Measures

PayPal employs stringent security measures to protect its users from fraud. These measures can sometimes flag legitimate transactions as suspicious, preventing the linking or use of certain cards. Cash App cards, being relatively new to the market compared to traditional bank-issued cards, might be more likely to trigger these security alerts.

Card Restrictions

As mentioned earlier, Cash App might impose restrictions on where and how the Cash Card can be used. These restrictions can be in place for various reasons, such as preventing fraud or complying with regulatory requirements. PayPal might be one of the platforms where the Cash App card has limited functionality.

Technical Glitches

Like any technology, both Cash App and PayPal can experience technical glitches that interfere with their functionality. These glitches can be temporary and resolve themselves over time, or they might require intervention from the respective support teams.

Insufficient Funds

Ensure that you have sufficient funds in your Cash App balance to cover any transactions you attempt to make through PayPal. Insufficient funds can lead to transaction failures and prevent the card from being used.

Tips for Successfully Using a Cash App Card for Online Transactions

Even if you can’t directly use your Cash App card on PayPal, there are still ways to use it effectively for online transactions.

Use the Cash Card Directly for Online Purchases

Many online retailers accept Visa debit cards directly. Instead of trying to use the Cash App card through PayPal, simply enter the card details at checkout on the retailer’s website.

Utilize Cash App Boosts

Cash App offers “Boosts,” which are instant discounts at various retailers. Check the Cash App app for available Boosts before making online purchases to save money.

Monitor Your Transactions

Regularly monitor your Cash App and PayPal accounts for any unauthorized transactions. This helps you identify and address any potential fraud or security issues promptly.

The Future of Cash App and PayPal Integration

As digital payment systems continue to evolve, the integration between platforms like Cash App and PayPal is likely to improve. Both companies are constantly working on enhancing their services and expanding their compatibility with other platforms. In the future, we may see more seamless integration between Cash App and PayPal, making it easier for users to manage their funds across both platforms.

Conclusion

So, can you use a Cash App card on PayPal? While it is generally possible to link a Cash App card to PayPal, some users may encounter issues due to card verification problems, restrictions, or technical glitches. If you face difficulties, troubleshooting steps like verifying card information, checking your Cash App balance, and contacting support can be helpful. Alternatively, you can use methods such as linking your bank account to both platforms or using a PayPal Cash Card to bridge the gap. By understanding the limitations and exploring alternative solutions, you can effectively manage your funds and make the most of both Cash App and PayPal.

Ultimately, the best approach depends on your specific needs and circumstances. By staying informed and proactive, you can navigate the complexities of digital payments and ensure a smooth and secure experience.